Understanding The OPM 2025 Pay Periods: A Comprehensive Guide

Understanding the OPM 2025 Pay Periods: A Comprehensive Guide

Related Articles: Understanding the OPM 2025 Pay Periods: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the OPM 2025 Pay Periods: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the OPM 2025 Pay Periods: A Comprehensive Guide

The Office of Personnel Management (OPM) plays a crucial role in managing the federal government’s workforce, including setting pay and benefits. The OPM 2025 pay periods, a recent initiative, represent a significant shift in how federal employees are compensated. This guide aims to provide a comprehensive understanding of these pay periods, their implications, and their potential benefits.

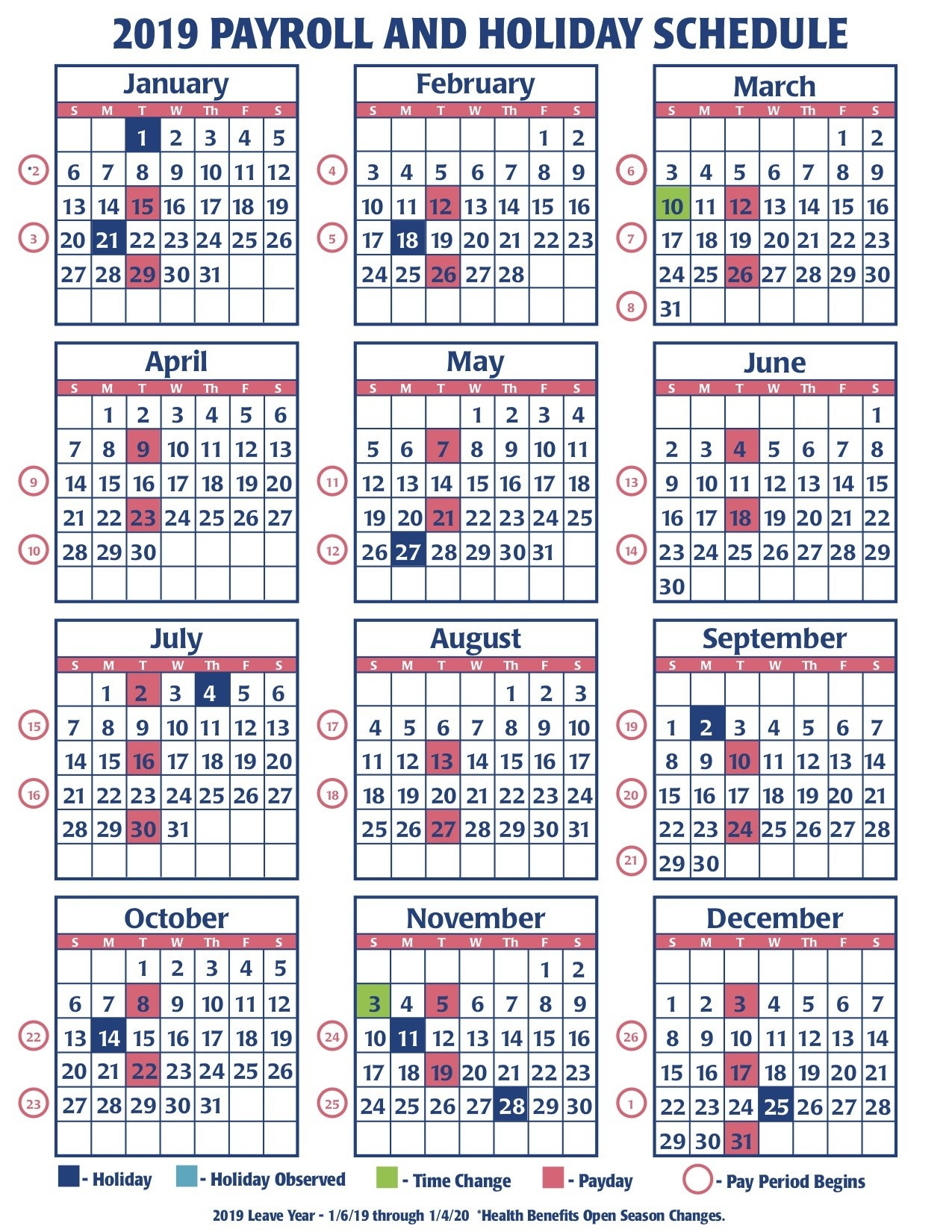

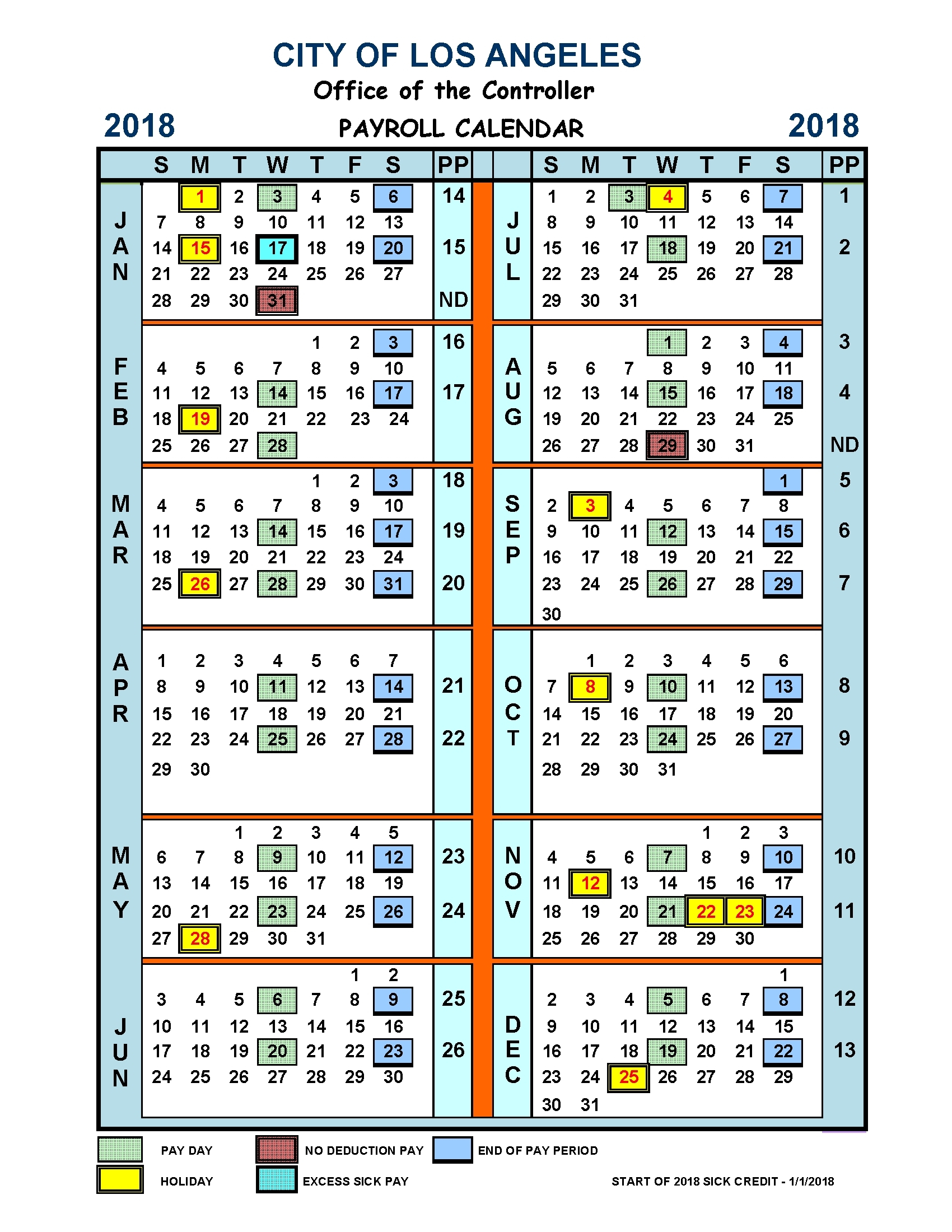

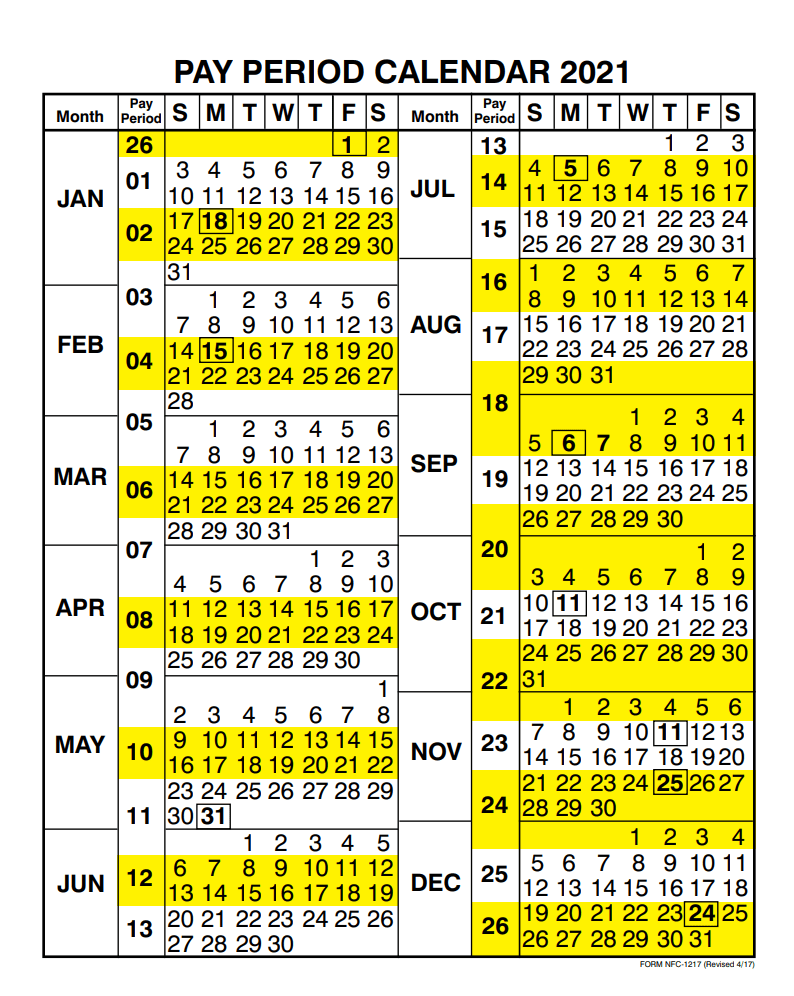

The Evolution of Federal Pay Periods

Historically, federal employees were paid bi-weekly, receiving their paychecks every two weeks. This system, while familiar, presented certain challenges. For instance, it could lead to uneven cash flow for employees, particularly those with irregular income sources. It also complicated budgeting and financial planning.

The OPM 2025 pay periods, a move towards a semi-monthly pay schedule, aim to address these challenges and introduce greater flexibility and predictability into federal employees’ finances.

The OPM 2025 Pay Periods: A Closer Look

Under the new system, federal employees will receive their paychecks twice a month, on the 15th and the last day of the month. This shift aligns federal pay with the common practice in the private sector, creating a more standardized and predictable pay cycle.

Benefits of the New Pay Schedule

The OPM 2025 pay periods are expected to bring several benefits for federal employees, including:

- Enhanced Financial Stability: Receiving paychecks twice a month provides employees with a more consistent income stream, enhancing their financial stability and making it easier to manage their budgets.

- Improved Cash Flow: The semi-monthly pay cycle allows employees to better manage their expenses and avoid potential cash flow issues, particularly for those with recurring bills or financial obligations.

- Increased Financial Planning Flexibility: With a predictable pay schedule, employees can plan their finances more effectively, making it easier to save, invest, or pay off debts.

- Reduced Administrative Burden: The new pay schedule simplifies payroll processing for agencies, reducing administrative burdens and freeing up resources for other critical tasks.

Implementation and Transition

The implementation of the OPM 2025 pay periods is a phased process, with a gradual transition to the new system. This phased approach aims to minimize disruption and ensure a smooth transition for employees and agencies alike.

FAQs Regarding the OPM 2025 Pay Periods

Q: When will the new pay periods take effect?

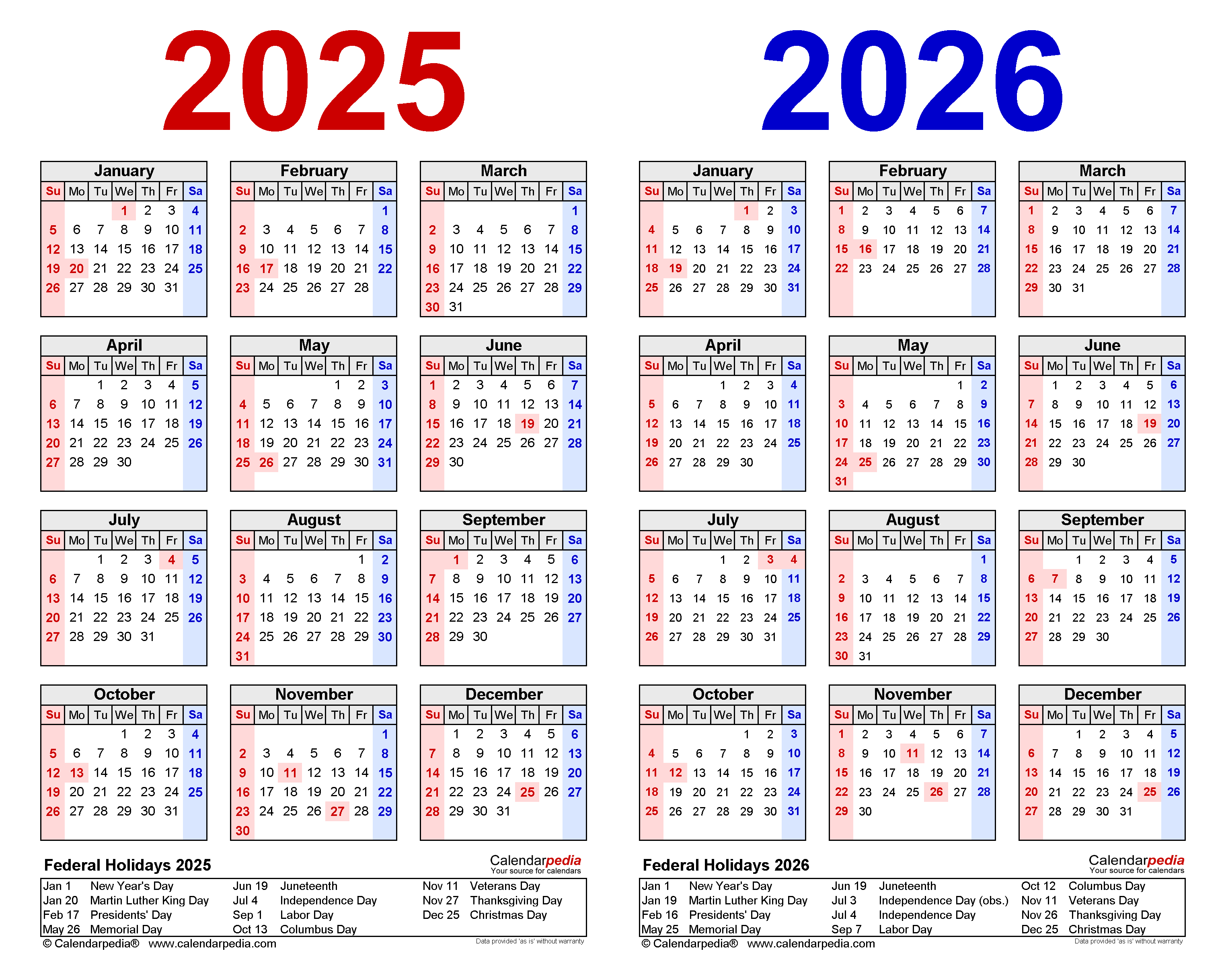

A: The exact implementation date for the OPM 2025 pay periods is subject to ongoing review and may vary depending on agency-specific requirements. However, the goal is to fully implement the new system by 2025.

Q: Will my pay be affected by the new pay schedule?

A: No, your gross pay will remain unchanged. The new pay schedule only affects the frequency of your paychecks, not the total amount you receive.

Q: How will my deductions be handled under the new system?

A: Deductions for taxes, retirement contributions, health insurance, and other benefits will be calculated and deducted based on your usual pay period and will not be affected by the new pay schedule.

Q: What if I am paid on a different schedule due to my specific work situation?

A: The OPM 2025 pay periods apply to the majority of federal employees. However, specific exceptions may apply to employees with unique work schedules or those paid under different pay systems.

Q: How can I stay updated on the implementation of the new pay schedule?

A: The OPM website and your agency’s internal communication channels will provide regular updates and information regarding the implementation of the OPM 2025 pay periods.

Tips for Adjusting to the New Pay Schedule

- Review your budget: Take the opportunity to review your budget and adjust it to accommodate the new pay schedule.

- Plan for potential changes: Consider how the new pay schedule might affect your spending habits and make adjustments as needed.

- Seek guidance if needed: If you have questions or concerns about the new pay schedule, consult with your agency’s human resources department or a financial advisor.

Conclusion

The OPM 2025 pay periods represent a significant step towards aligning federal employee pay with current best practices and enhancing financial stability for the federal workforce. By providing a more predictable and consistent pay schedule, the new system aims to benefit employees by simplifying financial planning, improving cash flow, and reducing administrative burdens. While the transition may require some adjustments, the long-term benefits of the OPM 2025 pay periods are expected to be substantial, contributing to a more financially secure and satisfied federal workforce.

Closure

Thus, we hope this article has provided valuable insights into Understanding the OPM 2025 Pay Periods: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!