Navigating The Indian Stock Market: Understanding NSE Holidays And Muhurat Trading In 2025

Navigating the Indian Stock Market: Understanding NSE Holidays and Muhurat Trading in 2025

Related Articles: Navigating the Indian Stock Market: Understanding NSE Holidays and Muhurat Trading in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Indian Stock Market: Understanding NSE Holidays and Muhurat Trading in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Indian Stock Market: Understanding NSE Holidays and Muhurat Trading in 2025

- 2 Introduction

- 3 Navigating the Indian Stock Market: Understanding NSE Holidays and Muhurat Trading in 2025

- 3.1 Understanding NSE Holidays in 2025

- 3.2 Unveiling Muhurat Trading: A Unique Trading Practice

- 3.3 FAQs on NSE Holidays and Muhurat Trading in 2025

- 3.4 Tips for Navigating NSE Holidays and Muhurat Trading in 2025

- 3.5 Conclusion

- 4 Closure

Navigating the Indian Stock Market: Understanding NSE Holidays and Muhurat Trading in 2025

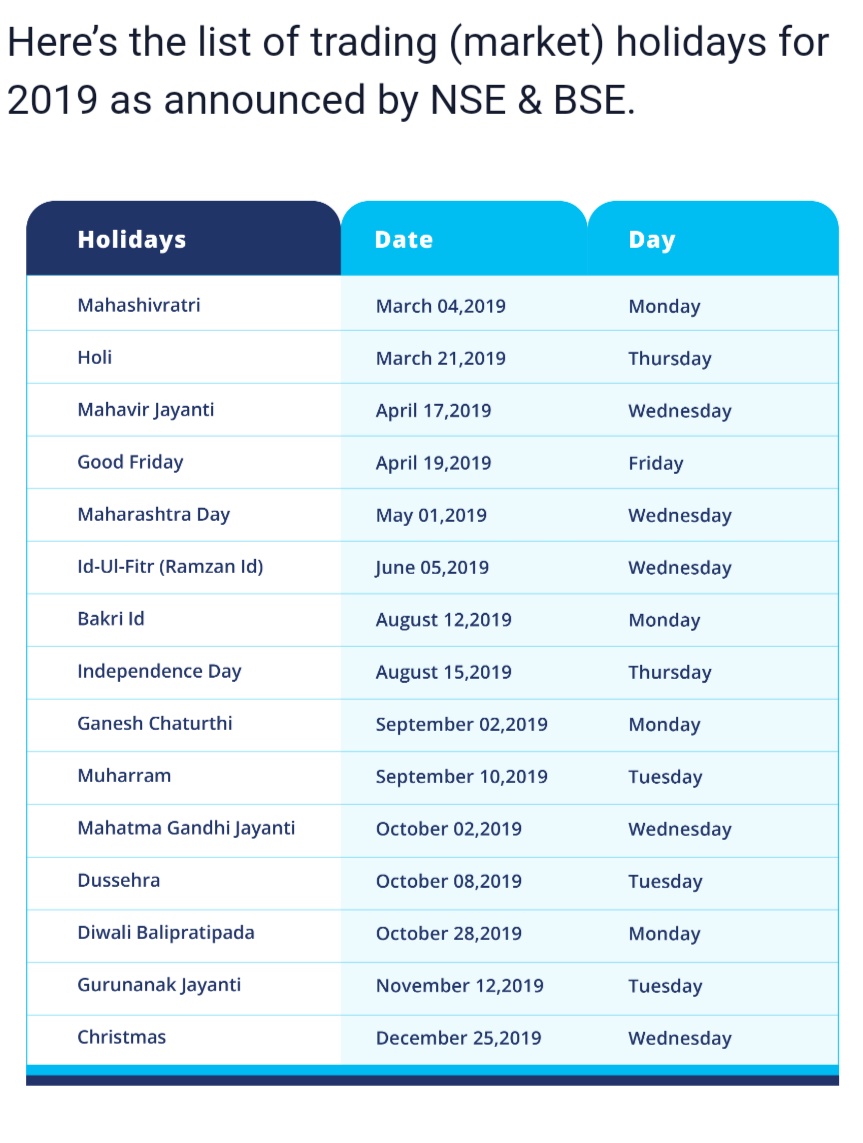

The National Stock Exchange of India (NSE) plays a pivotal role in facilitating trading activities within the country’s financial landscape. To ensure smooth operations and accommodate cultural and religious observances, the NSE observes a set of annual holidays. These holidays, alongside the unique practice of "Muhurat Trading," directly impact the trading calendar and provide valuable insights for investors.

Understanding NSE Holidays in 2025

The NSE holiday list for 2025 is designed to reflect a combination of national, religious, and regional holidays. These holidays are crucial for investors to note as they indicate days when trading activities will be suspended.

Here’s a comprehensive list of NSE holidays in 2025:

National Holidays:

- Republic Day: January 26th

- Holi: March 7th and 8th

- Good Friday: April 18th

- Mahavir Jayanti: April 25th

- Eid-ul-Fitr: May 2nd

- Independence Day: August 15th

- Ganesh Chaturthi: September 2nd

- Dussehra: October 2nd

- Diwali: October 27th

- Christmas Day: December 25th

Regional Holidays:

- Gudi Padwa: April 1st (Maharashtra)

- Ugadi: April 1st (Andhra Pradesh, Karnataka, Telangana)

- Baisakhi: April 13th (Punjab, Haryana, Himachal Pradesh, Jammu & Kashmir)

- Rath Yatra: June 22nd (Odisha)

- Onam: August 29th (Kerala)

- Dussehra: October 1st (West Bengal)

- Diwali: October 26th (Gujarat, Maharashtra, Rajasthan)

Trading Halts:

-

Trading will be halted for half a day on the following days:

- Mahashivratri: February 18th (Trading will close at 1:00 PM)

- Raksha Bandhan: August 14th (Trading will close at 1:00 PM)

Important Considerations:

- This list is subject to change based on official announcements by the NSE.

- It’s crucial to consult the NSE website or other reliable financial news sources for the most up-to-date information.

- Investors need to plan their trading activities accordingly, ensuring they are aware of the trading schedule and avoiding potential disruptions.

Unveiling Muhurat Trading: A Unique Trading Practice

Muhurat Trading is a special trading session that takes place on the day after Diwali, a significant Hindu festival. This tradition dates back centuries and is believed to bring good luck and prosperity. The session typically lasts for an hour, offering investors an opportunity to initiate new investments or engage in auspicious transactions.

Significance of Muhurat Trading:

- Symbolic Importance: Muhurat Trading embodies the belief that starting new ventures during auspicious periods can lead to favorable outcomes.

- Market Sentiment: The session often witnesses increased trading volume and volatility, reflecting the heightened optimism and enthusiasm associated with the festival.

- Investment Opportunity: Investors view it as a chance to capitalize on the positive market sentiment and potentially gain an advantage in their portfolios.

Practical Considerations:

- Limited Trading Hours: The session typically lasts for an hour, limiting trading opportunities.

- Increased Volatility: The heightened market activity can lead to greater price fluctuations, demanding careful trading strategies.

- Market Sentiments: The session’s success can be influenced by overall market conditions and investor sentiment.

FAQs on NSE Holidays and Muhurat Trading in 2025

Q1: What are the key differences between NSE holidays and Muhurat Trading?

A1: NSE holidays are designated days when the stock market is closed for trading, usually to observe national, religious, or regional holidays. Muhurat Trading, on the other hand, is a special trading session that takes place on the day after Diwali, offering a brief opportunity for trading with symbolic significance.

Q2: How do NSE holidays impact trading activities?

A2: NSE holidays disrupt the normal trading schedule, halting all market activities for the duration of the holiday. Investors need to plan their trading strategies accordingly, ensuring they are aware of the holiday calendar and avoid potential disruptions.

Q3: What is the significance of Muhurat Trading?

A3: Muhurat Trading is steeped in cultural and religious significance, with the belief that starting new ventures during auspicious periods can lead to good fortune. It also reflects the positive market sentiment associated with the Diwali festival, potentially attracting increased trading activity and volatility.

Q4: How does Muhurat Trading differ from regular trading sessions?

A4: Muhurat Trading is a limited-time session, typically lasting for an hour, compared to the regular trading hours of the NSE. It also often witnesses higher trading volumes and volatility due to the unique market sentiment and investor enthusiasm associated with the event.

Q5: Is Muhurat Trading a reliable indicator of future market performance?

A5: Muhurat Trading is primarily a symbolic event, and its outcomes do not necessarily predict future market trends. While it can be an exciting opportunity, investors should approach it with caution and rely on sound investment strategies and market analysis.

Tips for Navigating NSE Holidays and Muhurat Trading in 2025

- Stay Informed: Monitor the NSE website and reliable financial news sources for updates on holiday schedules and any changes to the Muhurat Trading schedule.

- Plan Ahead: Factor in NSE holidays when planning your trading activities, ensuring you avoid disruptions and capitalize on trading opportunities during open market days.

- Understand Muhurat Trading: Research the tradition, its significance, and potential implications for market activity before participating.

- Exercise Caution: Approach Muhurat Trading with a calculated strategy, considering the limited trading hours and potential volatility.

- Diversify Your Portfolio: Regardless of the trading session, maintain a diversified investment portfolio to mitigate risks and enhance long-term returns.

Conclusion

The NSE holiday list and Muhurat Trading are integral components of the Indian stock market, offering insights into the interplay between cultural traditions, market dynamics, and investor behavior. By understanding these aspects, investors can navigate the market effectively, ensuring their trading activities align with the unique calendar nuances and potentially capitalize on the opportunities presented. While NSE holidays may disrupt the regular trading schedule, they provide valuable time for reflection and strategic planning. Muhurat Trading, on the other hand, offers a unique opportunity to participate in a culturally significant event, potentially bringing good fortune and reflecting the positive market sentiment associated with Diwali.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Indian Stock Market: Understanding NSE Holidays and Muhurat Trading in 2025. We appreciate your attention to our article. See you in our next article!